Speaker: Mislav Matejka, CFA, Head of Global Equity Strategy

SPW, an equal-weighted S&P500 index, has stalled since March, and is behind SPX so far this year by more than 10%. We think this is reflecting a changing Growth-Policy narrative vs early 2024. Entering this year, investor expectations were for a Goldilocks outcome – growth acceleration and at the same time quick Fed easing, starting already in March. The early Fed cuts and the consequent improving credit impulse didn’t materialize, which should weigh on growth in 2H. US activity momentum is slowing, with CESI outright negative at present, putting EPS growth projections of as much as 15% acceleration between Q1 and Q4 of this year at risk. Instead of easing preemptively for market-friendly reasons, such as falling inflation, as was the view at the start of the year, the Fed could end up easing, but reactively, in a response to weakening growth. At the same time, there is no safety net any more, the market is positioned long, Vix is at lows, potentially underpricing risks and credit spreads are extremely tight – this is as good as it gets. Adding to the picture strengthening USD and elevated political uncertainty currently, we arrive at a problematic setup for the equity market during summer. In terms of positioning, we have entered this year again OW Growth vs Value style and Large vs Small caps, and we are keeping these for 2H in the US, not expecting much broadening. The recent relative dip due to French political uncertainty is likely to become a buying opportunity as we move through 2H, but we think the risk of further drawdowns is not finished, as the potential new French government will likely try to test the limits of what they can do.

This podcast was recorded on 30 June 2024.

This communication is provided for information purposes only. Institutional clients can view the related report at https://www.jpmm.com/research/content/GPS-GPS-4735603-0 for more information; please visit www.jpmm.com/research/disclosures for important disclosures.

© 2024 JPMorgan Chase & Co. All rights reserved. This material or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan. It is strictly prohibited to use or share without prior written consent from J.P. Morgan any research material received from J.P. Morgan or an authorized third-party (“J.P. Morgan Data”) in any third-party artificial intelligence (“AI”) systems or models when such J.P. Morgan Data is accessible by a third-party. It is permissible to use J.P. Morgan Data for internal business purposes only in an AI system or model that protects the confidentiality of J.P. Morgan Data so as to prevent any and all access to or use of such J.P. Morgan Data by any third-party.

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

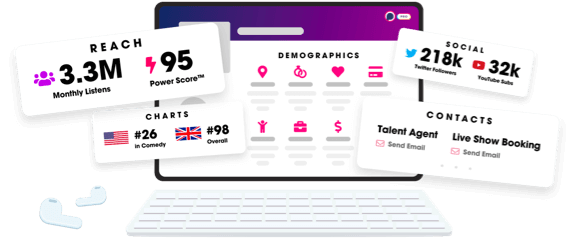

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us