Jason welcomes real estate analyst Rick Sharga. Rick discusses the housing market and economic trends. Despite concerns of a crash, he suggests a slow period with modest price increases rather than a downturn. He dismisses crash predictions, highlighting historical data showing home prices generally rise during recessions. Sharga addresses factors like consumer spending, job growth, inflation, and Fed policies influencing mortgage rates. He acknowledges the possibility of a mild recession due to Fed actions but emphasizes it may not significantly impact real estate if inventory remains low and distressed sellers are scarce.

Rick also dives into the NAR lawsuit and the current state of the housing market, highlighting mortgage rates near 20-year highs affecting purchase loan applications and pending home sales due to decreased affordability. He anticipates gradual mortgage rate declines attracting more buyers than sellers, likely resulting in increased competition and rising prices. Existing home sales show a 6.5% year-over-year price increase, while new home prices have decreased by 15% from peak levels. Investor purchases remain robust, primarily driven by individual investors rather than institutions. Flipping activity has declined due to pricing challenges, but gross profits are improving, indicating a potential resurgence.

#RickSharga #RealEstateTrends #HousingMarket #HomeSales #MortgageRates #NARLawsuit #AffordabilityCrisis #MarketAnalysis #FoxBusinessInsights

https://cjpatrick.com/

Follow Jason on TWITTER, INSTAGRAM & LINKEDIN

Twitter.com/JasonHartmanROI

Instagram.com/jasonhartman1/

Linkedin.com/in/jasonhartmaninvestor/

Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/

Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund

CYA Protect Your Assets, Save Taxes & Estate Planning:

http://JasonHartman.com/Protect

Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals

Special Offer from Ron LeGrand:

https://JasonHartman.com/Ron

Free Mini-Book on Pandemic Investing:

https://www.PandemicInvesting.com

From The Podcast

Heroic Investing Show

The challenges faced by first responders in the medical, rescue, police, and military have never been greater. Each day that you report for duty, your personal well-being is placed on the line as you step up to fulfill your duty and help people. It is unfortunate that the contributions of first responders are very rarely recognized for the priceless gift that they really are.In addition to the physical dangers faced on the job by first responders, there is a hidden danger that may impact the financial lives of many first responders whom society depends upon for its very well-being. This hidden danger is the underfunded pension and retirement plans for police, fire, medical and military professionals. Federal, state and local governments all across the country and around the world are experiencing budget difficulties that make it difficult to finance pensions at a level that is sufficient for retirees to fully support their standard of living. This phenomenon may leave many first responders facing retirement years under extreme pressure from financial difficulty.At Heroic Investing, we are dedicated to showing first responders a different way to build their financial future. The future is uncertain but first responders have extensive knowledge of how things can change in an instant. The hero’s of society have always been the people who protect our safety and respond to emergencies. You have dedicated your career to making sacrifices for the public good. These sacrifices should be rewarded with a financially secure future and a good retirement lifestyle. This is the reason why pensions were created in the first place and our sincere hope is that our heros have a secure and abundant future.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

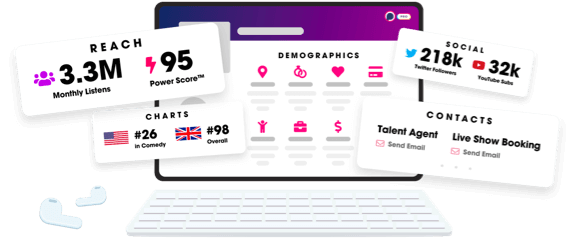

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us