Watch the Video Podcast on YouTube. Click here...

The 2008 financial crisis caught retiring Americans off guard. This catastrophic financial event wiped out big chunks of America’s retirement savings and affected the economy long after the stock market recovered.

Now, retirees are faced with a double whammy. A rising health concern from the CoronaVirus, COVID-19, coupled with the Dow Jones industrial average falling into a bear market.

A bear market begins when stocks have fallen 20 percent from their high. Though it’s a somewhat arbitrary threshold, in financial markets the designation acknowledges what many investors are surely feeling — and that is, fear-based trading in the stock market may not end soon.

In this presentation you will learn:

- How you can plan a secure future when you are just 10 years away from retirement.

- How the SECURE Act Helps You Shield Up to 25% or $135,000 of RMDs From Taxes

- Safe Ways to Protect and Grow Your Retirement Savings Without Stock Market Risk

- How Sequence of Returns Works in a Bear Market

- How Annuity Laddering Works

As you get closer to retirement, it's important to start planning your retirement income strategy or you may need a refined or updated income plan that helps you achieve your specific retirement goals. If you would like assistance with exploring options (potentially outside of your 401(k) plan), assessing your current strategy, and taking steps to meet your goals, you need to make sure you have a trusted advisor or agent to help you.

A great agent will walk you through the entire process. Our agents have helped hundreds of individuals move their retirement savings into the safety and security of life insurance backed products and fixed annuities.

Contact us today if you are recently retired or have stopped contributing to your retirement savings account. We can show you your options to ensure that your retirement is as hassle-free and predictable as possible. Log onto JenniferLangFinancialServices.com and simply request a free no obligation phone consultation. We’ll be happy to help you.

See Related Article: Things You Need to Know About Retiring in 10 Years

https://communalnews.com/things-you-need-to-know-about-retiring-in-10-years/

#retirement #financialadvice #annuity #annuityquote #financialadvisor

From The Podcast

Jennifer Lang

No-market Risk & Safe Money Advisor, Jennifer Lang teaches families & business owners safe retirement planning and wealth accumulation strategies. to protect principle & grow wealth.As market volatility increases, investors and employees with 401(k) plans are starting to have flashbacks of 2008's down turn and are looking for safe money retirement strategies to protect their nest egg.Jennifer Lang addresses top of mind topics such as how to not outlive your nest egg, keep up with inflation & how to plan for Long Term Care costs.https://www.annuityquoteadvisor.comJoin Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

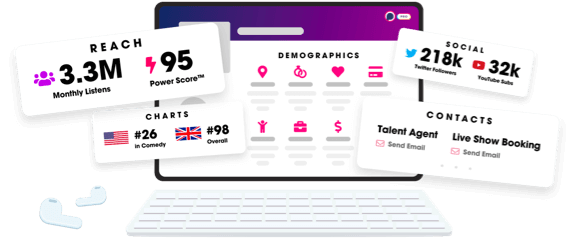

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us