Kyle welcomes back to the pod interactive investor’s Personal Finance Editor Craig Rickman to discuss some of the dilemmas people face when investing during retirement. Among the topics discussed are the ‘4% rule’, only taking the ‘natural yield’ and having ‘cash buckets’. As ever, bear in mind the podcast is for information purposes only and is not financial advice.

On The Money is an interactive investor (ii) podcast. For more investment news and ideas, visit www.ii.co.uk/stock-market-news.

Kyle Caldwell is Collectives Editor at interactive investor.

Important information:

This material is intended for educational purposes only and is not investment research or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy. The value of your investments can rise as well as fall, and you could get back less than you invested. Past performance is not a guide to future performance. The investments referred to may not be suitable for all investors, and if in doubt, you should seek advice from a qualified investment adviser. SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future. If you are in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of these products, you should contact HMRC or seek independent tax advice. Interactive Investor Services Limited is authorised and regulated by the Financial Conduct Authority.

From The Podcast

On The Money

Every week, Kyle Caldwell and guests take a look at how the biggest stories and emerging trends could affect your investments, with practical tips and ideas to help you navigate your way through. Join the conversation, tell us what you want us to talk about or send us a question to OTM@ii.co.uk. Visit www.ii.co.uk for more investment insight and ideas.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

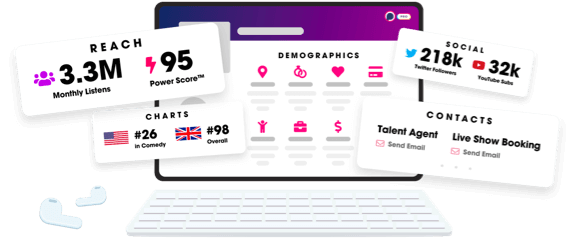

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us