Part 1 of our discussion about Cryptocurrency and Taxes started with the question that appeared for the first time on the 2019 tax return, which reads:

“At any time during the tax year, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency.”

A response of “yes” to this question usually means you’ve triggered a taxable event from your virtual currency transactions, which must be reported on your tax return.

Virtual currency is a digital representation of value. You can access it digitally and spend it at a variety of places. Virtual currency operates like “real currency” except it does not have legal tender status in the United States. For tax purposes, we refer to convertible virtual currencies, which means they can be converted in and out of US Dollars. Non convertible virtual currencies such as those that are purchased to play games on your phone, computer, or gaming console can only be used within the gaming system and can’t be converted back to US dollars. These non-convertible virtual currencies are not the subject of our discussion.

Cryptocurrency is a type of virtual currency. It uses cryptography to record secure transactions digitally on a distributed ledger such as blockchain. Bitcoin, Ethereum, Litecoin, and Ripple are popular types of cryptocurrencies. The use case for crypto has expanded and evolved to an eco-system since Bitcoin first launched in 2009.

Entering the cryptocurrency eco system may feel like jumping into a game of double dutch jump rope. As a jumper, how do you know when to jump in? Once you’re in, how do keep jumping without stepping on and stopping the ropes from turning? Learning about cryptocurrency is one step into the crypto journey.

Here’s part 2, the remainder of the conversation, with John Wingate, CEO at BankSocial™ and crypto expert. We discuss the growing popularity of decentralized finance, DeFi, and its impact on banking and financial systems as we know them. John ends the conversation by providing tips to begin your journey into cryptocurrency.

BankSocial™ is the first and only Decentralized Banking and Finance Platform, built 100% from the ground up on the Blockchain, that pays the banks members for holding tokens to fund loans.

Website: https://www.banksocial.io

Email: john@banksocial.io

LinkedIn: https://www.linkedin.com/company/banksocial

FB: https://bit.ly/3ffSL4K

Twitter: https://twitter.com/banksocialio

YouTube: https://youtube.com/BankSocial

IG: https://www.instagram.com/banksocial.io

**********

Thank you for listening.

As with any tax issue, contact your tax professional to help you navigate your own unique situation.

Support the show (https://www.buymeacoffee.com/practicaltax)

From The Podcast

Practical Tax Talk

Each episode of Practical Tax Talk™ features a discussion about a tax topic with tips and resources to help you manage your tax situation. We invite people like you, organizations, and a range of tax experts and practitioners to share stories and experiences connected with the topic to help you understand and plan for tax consequences triggered by life and financial events.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

Unlock more with Podchaser Pro

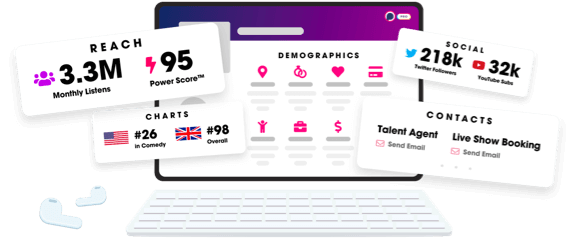

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us