According to Randon Morris, few years back, senior citizens could hardly get a health insurance policy due to the health challenges that come with old age and the medical treatment expenses involved. You can hardly find any insurer that is ready to provide health insurance for elderly people above the age of 60 at that time.

Thankfully things have changed over the years as senior citizens now have health insurance options, says Randon Morris.

What Is a Health Insurance Policy for Senior Citizens?

Health Insurance Policy for Senior Citizens is a type of insurance policy that is made especially for people above 60 years of age. It is designed to help senior citizens financially and to cover any medical expenses.

In case you are planning to buy health insurance for your parents or you want to buy one for yourself as a senior citizen. Here are some tips recommended by Randon Morris, that can help you make the right decisions, while buying a health insurance policy for senior citizens.

Coverage for Pre-existing Ailments

Pre-existing ailments is referring to any medical issues that someone has been diagnosed with before buying health insurance. In most cases, senior citizens have higher chances of developing pre-existing ailments than younger ones. Insurance companies in most cases specify the waiting period before they can cover expenses that are related to pre-existing medical issues. You should know that not all insurance companies cover every pre-existing ailment so you should check the list of pre-existing diseases the insurance plans cover before buying.

Check the Sub-Limits

For certain medical treatments that are costly, health insurance companies place sub-limits on the amount of claim. This means once the maximum amount of claim the company placed on some treatment is reached the insured person will have to pay for the extra cost, says Randon Morris. When choosing a plan, it is better to select the one with no sub-limits or check the list of treatments that have sub-limit before buying. This way you can choose the plan that matches your needs or requirements.

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

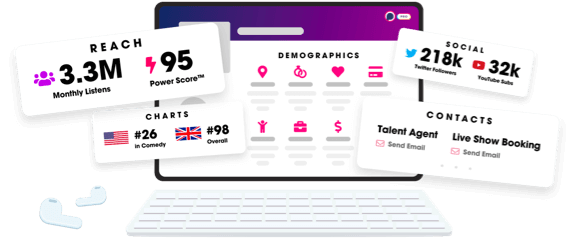

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us