On this important episode of the Sales Gravy Podcast, Jeb Blount, Jr (a.k.a JBJ) discusses personal finance for sales professionals with Ben Lex, a former B2B sales superstar turned financial advisor. Ben shares game-changing insights tailored specifically for sales professionals.The Financial Fitness MindsetIn sales, we're all about closing deals, hitting targets, and making more money. But what happens after you receive that hefty commission check?

Too often, sales professionals fall into the trap of spending impulsively, only to face financial stress later. This is exactly why you need to adopt a financial fitness mindset which means making deliberate, strategic decisions about your money, just as you do with your sales strategy.Delayed Gratification: Your Secret WeaponOne of the most powerful tools in your financial arsenal is the ability to delay gratification. True financial stability comes from resisting the urge to splurge on every big commission check. Instead, consider setting aside a portion of your earnings for future goals. This practice not only builds financial security but also reduces stress during lean months.Build An Emergency FundAn emergency fund is non-negotiable. Sales professionals, especially those with variable incomes, should have enough saved to cover six months to one year of living expenses. This safety net acts as a buffer, ensuring you’re not living paycheck to paycheck and allowing you to make decisions from a place of strength rather than desperation.Unload High-Interest DebtCarrying high-interest debt is like running a marathon with a backpack full of bricks. It slows you down and makes reaching your financial goals much harder. Paying off high-interest debt should be your top priority. This includes credit card balances and high-interest car loans. Eliminating this debt frees up your income and allows you to invest more effectively in your future.Smart Investing: The Path to WealthOnce your debt is under control and you have an emergency fund, it’s time to think about investing. Focus on diversification. This means spreading your investments across various asset classes to mitigate risk and ensure steady growth.

If your company offers a 401(k) max it out before you make any other investments. If your company matches investments you make in your 401(k) make sure that you take full advantage of this free money. Leave nothing on the table.

Remember, investing is a long-term game. It's about building wealth gradually, not getting rich overnight.Set Clear Financial GoalsJust as you set sales targets, setting clear financial goals is essential. Whether you’re planning for retirement, saving for your child’s education, or aiming to buy a lake house, having specific goals will guide your financial decisions. Take the time to map out your goals. Consult with a financial advisor when possible. This process helps you stay focused and make informed choices about where to allocate your resources.

Actionable Steps to Financial Mastery

Assess Your Financial Health: Start by evaluating your current financial situation. Look at your income, expenses, and debts to get a clear picture of where you stand.Create a Budget: Develop a budget that tracks your earnings and expenditures. This will help you identify areas where you can cut back and save more.Prioritize Debt Repayment: Focus on paying off high-interest debt first. This will free up more of your income for savings and investments.Build Your Emergency Fund: Aim to save enough to cover at least six months of living expenses. This fund will provide financial stability during tough times.Maximize Retirement Contributions: Take full advantage of employer-sponsored retirement plans, especially if they offer matching contributions. This is essentially free money that can significantly boost your savings.Diversify Your Investments: Work with a financial advisor to create a diversified in...

From The Podcast

Sales Gravy: Jeb Blount

Jeb Blount is the bestselling author of 15 of the most definitive books ever written for the sales profession. He believes that Sales Professionals are the Elite Athletes of the Business World. On the Sales Gravy podcast Jeb teaches you how to open more doors, close bigger deals, and rock your commission check.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

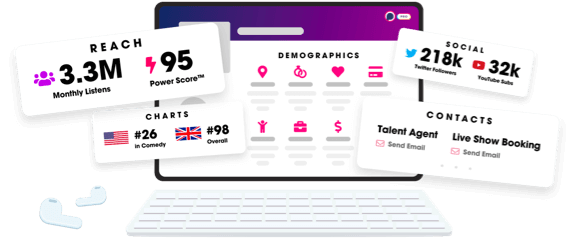

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us