Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:00

Hello, everyone. I'm John Montoya, and I'm John Perrings.

0:04

We're authorized Infinite Banking Practitioners and hosts of the

0:07

Strategic Whole Life Podcast. Episode 109.

0:12

Today we have a special guest, Dave Mozica, co founder of the

0:18

cash flow platform called Currence.

0:21

And, as you're listening to this, or before you listen to this, make sure

0:24

you also check out episode 103, where we talk about the problem of saving and

0:29

spending being Significantly overlooked in favor of trying to get high returns.

0:36

And no one really talks about saving and spending anymore.

0:39

And that's why we're here to talk about it today.

0:42

And if 103 was about the problem, today's episode is about the

0:46

solution to that problem. And the solution to that problem is a banking and technology

0:50

platform called Currence. And.

0:53

Here's the deal with it. Budgeting sucks and it doesn't work anyway.

0:57

And people either don't do it, they don't stick with it or if they actually do it,

1:02

they spend way too much time doing it. And so if you've ever wished you could benefit from the idea behind budgeting

1:08

without actually having to do all the things that don't work, stick around

1:11

because Dave Mozica is going to talk about how focusing on your cash flow

1:16

structure can Financial improvements that you never thought was possible.

1:20

So Dave, welcome to Strategic Whole Life.

1:24

And let's jump into it here. Could we just start by understanding a little bit about your background and

1:29

how Currence was actually developed, and then we can dive into Currence itself.

1:34

Absolutely. And thanks for having me. I'm grateful for the opportunity to be here and share occurrence with

1:39

your audience and grateful for you to be a occurrence practitioner and

1:44

being able to deliver the solution to the people that you serve.

1:48

So you asked me a little bit about my background and, So, I graduated college

1:52

in 2001 on a Thursday and on the next Monday I was a financial advisor and so

1:59

I, I've spent my life in the insurance space and in, in advising and I got lucky.

2:05

I was it was interesting about our industry is that every advisor really

2:10

gets recruited into the industry.

2:12

It's not you went to. A career fair.

2:15

And you said, Oh, that's what I want to do. It's like we all get introduced to this career.

2:19

And I think what happens when you get introduced with the way that

2:25

you're introduced or the people that you surround yourselves with really

2:28

early in your career, have a way of shaping your vantage point and how

2:32

you see the world of personal finance. And so I got lucky.

2:37

I was recruited into the industry and I was exposed to some

2:41

of the most brilliant minds. In this space, because I really look at like the insurance industry and

2:46

you have two ends of the spectrum.

2:48

You have some of the most brilliant minds in the world in our industry, and

2:52

then you have a whole bunch of people that could like barely fog a mirror.

2:56

And and it's really hard for consumers on their side of the

2:59

table to see the difference. And so I was trained in macroeconomics, understanding cash flows, right?

3:05

I was trained third party where most people in our industry.

3:08

Our training in sales and marketing on how to sell the products that

3:10

the institutions want to provide. So I was off to a fast start.

3:14

I happen to be right for the industry. I really always thought going through college that I was going to end up

3:19

working for my father, and then I got exposed to this industry by a family

3:23

friend, and I said, you know what?

3:25

Let me go see what I'm worth on my own before I.

3:28

ride my dad's coattails and because he had a successful business at the time.

3:32

And I just happen to love the industry and I was trained in, again, as I

3:36

said, macroeconomics and understanding how money is really finite.

3:41

And when you understand that money as a resource is finite, that you begin to

3:45

understand that every choice that we make affects everything else in our lives.

3:49

So during my journey in the insurance and planning space, I

3:56

was always captivated by cashflow.

3:59

And I was at the same time, simultaneously receiving incredible education on the

4:05

understanding of how money works, leverage points, how we should be playing the chess

4:10

match and putting all the pieces together. And early in my career, as I'm proposing solutions to people that I know they

4:17

need to implement to have their lives work out in a guaranteed fashion.

4:21

Like people struggled, like they didn't have the confidence early

4:23

in my career to make those choices. They didn't understand where the money was going to come from.

4:27

And that's what really caused me to dive into understanding where's the money?

4:34

How do we create a structure that people have confidence in the way

4:37

that they make financial decisions? And when we were doing this, one of the things that we were doing was we were

4:43

teaching people to segregate They're spending money from their savings, right?

4:48

Everybody knows we need to save first and spend second.

4:51

But there's really no way to do that. And so early in my career, I was always successful.

4:57

And when I started really diving into cash flow planning, is when my career took off.

5:03

And I would see that in the trajectory of the lives of my

5:06

clients and the people I was serving. And as I was having these, I'm sure we're going to dive into it even deeper, as I

5:12

was having this, these outsized results in my relationships with the quality of

5:16

the clients the or the the trajectory that we were able to put them on, it became

5:21

obvious that we needed to build something to make it available to everybody.

5:24

If you could give just like a, I don't know, like an elevator talk

5:28

or like a, five second overview or one minute overview of what Currence

5:32

is, that way we can just get into the nitty gritty of everything.

5:35

By the way, I just want to say, I use Currence personally

5:38

in my own life and it's made.

5:41

Uh, Profound difference in just finding money that was previously

5:47

just getting away from me. And instead of me trying to say it, maybe I'll just turn it over to

5:52

you and you can just tell everybody what is Currence from a high level.

5:55

And then we can go macro and just, and then dive into the details

6:00

I'll put it this way. Currence is a structural solution.

6:04

Which is about how to integrate and build what we call a cashflow structure.

6:10

Without structure, you're victim to the outside world.

6:13

Like the world we live in is designed to take our money away from us.

6:16

It's really easy to spend money. And what we found is that through my journey of doing this as a as we're

6:24

tinkering around and, this was 15, almost 20 years ago that we were tinkering

6:29

around with the direction of cashflow. So I really want your audience to understand the

6:32

direction of cashflow is huge.

6:35

And what I mean by that is when we all make money, what do we typically do?

6:40

Where do you put it? You get a paycheck. Where does it go?

6:44

right into your checking In your Or actually it gets siphoned off into your qualified plans first.

6:48

And then, but yeah, right. So if you look at, if you look at the pattern of the money you get

6:53

paid, you're like, wow, I got paid. And then you're like, oh my God, I'm partners with the government.

6:57

I didn't realize that, and, or to the extent that you're

6:59

partners with the government. And you lose, state and local taxes, federal income taxes, social security

7:04

taxes, there's a huge evaporation or confiscation of your income immediately

7:10

before it even shows up in your world. And then if you look at the next line items on your pay stub, you'll see

7:15

contributions into your, maybe your retirement plan, which is not necessarily

7:18

a bad place to accumulate money. It's the order in which we do things is really important, right?

7:23

It should not be the first place because you're just putting money

7:26

in jail and it's only doing one job. And then you look at, you may be paying for benefits or voluntary

7:31

benefits and then after all that, then you finally get to bring money home.

7:34

And we call that financial gravity, right?

7:37

Like when you bring money home, then you got to deal with your housing

7:40

costs, your fixed expenses, your variable expenses, the kids costs,

7:43

et cetera, et cetera, et cetera. And we all like to enjoy our lives a little bit and deserve to, if you're

7:48

working hard, you want to go on vacation, you want to go out to dinner, right?

7:51

And then you have Amazon, Netflix, all these things showing up in your life.

7:54

And it's chaotic. But the pattern is take your money, put it right into your checking

8:00

account, which is really when you think about it, it's an expense account.

8:04

It's designed to pay bills. It's designed for spending.

8:08

So if we're sending all our money to the spending environment, what

8:11

is that actually going to promote? Spending, right?

8:15

So what we really, and then what we have to do in order to get ahead, like

8:19

your savings rate, the amount of money you keep is the number one indicator

8:22

of your financial health, right? And so you have to fight all that gravity and then take money and put it

8:28

away manually and choose to do that. In the face of this crazy life that we live, we all live, right?

8:34

And it's funny. About an hour ago, I realized that my I forgot to give my daughter lunch money.

8:40

And I was like, able to just send her Apple pay.

8:42

Like it's so easy to have the money. Just leave us.

8:44

You know what I mean? So it's she called me from school.

8:47

It's amazing. The convenience. That exists in the world of spending

8:52

Just as a quick aside, I have another friend that took his son's credit

8:56

card away because he didn't do what he was supposed to be doing.

8:59

And then he found out his credit card was just tied to his Apple Pay.

9:02

And so his son was just continuing to spend on his Apple Pay.

9:05

Anyway got right around that. Yeah, it's amazing It's impossible to keep track of all the different ways

9:11

that your financial life on the spend side is connected to so Basically

9:15

what Currence does is we reverse the direction, we reverse the order of

9:19

operations so that you create a world where you're always saving money.

9:23

So the way that we do that is our clients, our users, open up what's

9:28

called a cash flow reservoir. It's a financial account, it's FDIC insured up to 3 million, it's a 6

9:34

million joint account, it earns a competitive rate of return, but that's

9:36

not really the purpose of Currence. The purpose of Currence is to be an intermediary between your money coming

9:42

into your life and the money going out. So what I mean is, rather than drop all your new monies into your checking

9:47

account and spend first, And then manually save our clients open up

9:53

a reservoir that intercepts every dollar that shows up in your life.

9:57

And then you choose how much money goes to your checking account

10:00

or the spending environment. So what happens is the you're taking what an environment that

10:07

was creating unconscious spending and creating an environment that

10:11

you have unconscious savings. So if you create the structure so that you're always defaulting to accumulating

10:18

and controlling your money and then just choosing how much money is leaving

10:22

your life and you automate that, then all future increases in income, all the

10:27

choices you make will actually promote increased savings rates over time.

10:31

So when you do this, it's as if every future increase in income

10:35

will automatically get saved unless you choose to spend it.

10:39

Where the reverse, the way most people are living, is that you have to choose

10:43

and manually put money away, which is difficult in the face of life and

10:48

all the things that are going on. So as a, just a question about, how.

10:53

Users perceive this.

10:56

Do you think people realize how big of a deal that is?

10:58

What you just said? So what you just said was we're turning unconscious spending and

11:04

we're flipping that around and creating unconscious savings.

11:07

Does that? Does that hit home with people right away when they hear that, or do they

11:12

have to start doing it to realize it? Yeah, you have to start, it's different.

11:16

It's all over the map but we hear things from our users like, I had no idea

11:21

how much money I was losing, right?

11:23

Just the awareness of. The money and every dollar is in its place, right?

11:28

You're, you think of it as two different environments, the saving

11:31

and wealth creation environment and the spending environment.

11:34

So I'd rather just choose how much money is leaving my life.

11:36

I have to choose now to mess my life up,

11:40

Yeah, exactly. right? So it hits home from some people.

11:43

And then what happens is over time, because the situation is

11:47

fluid as you go through time. And it's like, wow, the beautiful thing about Currence is that you disconnect.

11:53

Your consumption choices from your income because if everything's going into the

11:59

checking account first Then what happens is your spending is always going to be

12:03

correlated to how much money you make Because it's just, it just evaporates.

12:08

So it And that's what we talked about in episode 103.

12:11

Sorry to interrupt you, but, you know, that,, that idea is so true

12:15

for so many people, regardless of how much money you make.

12:18

If you make 50 grand a year or, 5 million a year.

12:22

Most people's spending will increase right along with how much money they make.

12:28

it's, it's these two lines that go up on the chart together.

12:32

And what we're trying to do is separate those lines a little bit.

12:35

And that's where you really start to create some acceleration

12:39

in your financial life. yeah so what happens is, like you said, exactly, they're going in parallel, right?

12:46

And then when you flip it, you create that behavioral interrupt and then

12:50

your consumption will stay flat as your income continues to rise and then you

12:54

live in a constant state of choice. Everything is hitting, all your money is hitting this pit stop and you're now

13:00

choosing, do I want to spend or do I want to go create something else that's going

13:05

to actually increase my income above and beyond what I can earn on my own?

13:09

And that's what happens is living in a state of choice

13:12

is very different for people.

13:15

And the amount of freedom and confidence that you end up having,

13:18

even myself, when I started doing it myself, it was like, Incredible.

13:22

Yeah same. And the, obviously as we go through life, we want to improve our standard of living.

13:29

We all want to have the things that we want to have.

13:32

We want to have the house or the car or take vacations, have

13:36

experiences with our family. So just to clarify when you separate the savings and the spending, we're

13:43

not saying you're going to live the same quality of life that you are now.

13:47

What we're saying is if you actually can consciously choose and create,

13:51

uh, you know, buy more assets that create income and cash flow , Even

13:57

though your percentage of spending stays, potentially flat, the amount of

14:02

money that you have will go up and up.

14:04

And so you're in an always in a position where you're creating growth,

14:07

but from that will allow you to spend without sacrificing that future growth.

14:13

Totally. And it's about freedom, right?

14:17

You want to have the freedom and the confidence to say, you know

14:19

what, we can take this vacation. Some of the best conversations I have with my clients are like, Wow.

14:24

You know what? We're built and now I see a new possibility for myself.

14:28

I actually feel, I don't feel guilty for taking the vacation now, taking my

14:32

family to Disney because you know what? Every dollar's in its place and I can see the trajectory that I'm on.

14:38

So it's, it becomes really freeing. It's cut.

14:42

It's all the things that. We hope to get from budgeting, but we don't have to do all that

14:48

because we just capture every single dollar that comes into our life.

14:52

And we know exactly what it's doing and how much needs to go where.

14:56

Yeah. I was just going to say the same thing. It's the opposite of budgeting because budgeting is about sacrificing, limiting,

15:01

making you feel guilty for spending money.

15:05

And it's you have to radically alter your life.

15:08

To have budgeting work, which is not promoting any kind of

15:12

happiness or success or quality.

15:16

What we're saying is, you know what, live the life you're living today.

15:20

Build the structure and allow yourself to grow into your maximum potential.

15:24

Allow yourself to grow into the best version of yourself.

15:28

That's it. And that's what we talked about in episode 103, that maximum financial

15:32

calculator exercise that Todd Langford does with his truth concept software.

15:37

And I think that's one of the most powerful talks because It

15:41

just demonstrates that we don't have to sacrifice anything today.

15:45

We can keep our existing lifestyle.

15:48

All we do is create an environment where in the future we can consciously

15:53

make decisions as our income grows.

15:55

We can now separate the savings and the spending to, to make our future better

16:01

without changing up our entire life today.

16:04

And it's incredible that you can, it demonstrates with math.

16:07

You don't have to go out there and chase high returns.

16:10

You can win by default. Just saving money, and it's way better than anything you can hope to do just by

16:17

hoping to get a high rate of return, but just continuing your, by keeping your

16:21

spending growing along with your savings.

16:24

It's or your income, I should Yeah. It's totally true.

16:27

And, there's a lot of things.

16:30

Here's another interesting thing to think about.

16:33

Let's imagine that you make 100, 000 a year, And let's say you got a 5

16:39

percent cost of living raise, right?

16:42

So 5, 000 minus all the taxes, it's I don't know, 3, 000.

16:48

Net of tax, the increase, right? And then, but the problem is that when that shows up in your

16:53

paycheck, that's only what?

16:55

125 a paycheck, right?

16:58

That gets lost in a second. But when you look at that through time over a decade, it amounts to

17:04

millions of dollars when you look at the future value of that money,

17:07

How easy is it to spend that 120 oh Oh, I got 125 or X number of

17:13

dollars in my checking account. Let's go out to dinner.

17:16

That's a, that's one dinner. That's half a dinner in

17:19

the Yeah. Yeah. If you even notice it, even if if you even notice it.

17:24

So those little victories that happen over your 30, 40 year working life,

17:30

that is the, that is your future.

17:32

That is your wealth that you need to control.

17:36

And that's what Currence has done because it's just giving, A context,

17:39

a framework for where you can make really intelligent financial decisions

17:44

because once you've put step one, which is create the structure of intercepting

17:48

your income and choosing your spending, then it just becomes a game of what's

17:52

going to make my life even better. What's the most efficient use of the capital that we're collecting.

17:58

So that could be in many different various investment vehicles or

18:02

insurance vehicles or whatnot. That's for you and your advisor to choose.

18:06

But if you think about it, when you invest money, you have the opportunity

18:11

to create passive income that's more efficient than your paycheck.

18:16

So as an example, you may be a business owner.

18:19

When you factor in all the deductions you get as a business owner, or if you

18:23

invest in real estate with depreciation deductions and, 1031 exchanges, you

18:28

could create income that on average is taxed at like 10 percent or even less.

18:32

You may want to be in, life insurance, right?

18:35

Life insurance produces cash flow that's taxed at 0%.

18:39

And unfortunately, what most people are doing, because their money's

18:42

flowing in the wrong way, they're putting every extra dollar they can

18:45

into the retirement plan, which looks good from an accumulation perspective.

18:50

But the reality is they're called retirement plans, but it's the

18:53

absolute worst place you can take money out in retirement.

18:55

So the order in which we do things is really important, but what you want

18:59

to do is put in place to accelerate what we call cashflow engines, which

19:02

are other vehicles that you could work with your financial professional

19:06

to help you decide that's just going to feed the reservoir even faster.

19:09

And then it becomes like taking your car from first gear to second

19:13

gear, to third gear, to fourth gear. Like you're still feeding it with the same amount of RPMs,

19:17

but you're going much faster. What's the, what does the technology or the process look like?

19:24

Maybe we could just dive into that a little bit.

19:26

Like how are we implementing Currence?

19:29

What are we doing? Where's our money going?

19:32

How does it come back out? All of those kind of things.

19:35

Yep. So step one would be to download Currence.

19:41

You'd have to get it through a financial professional like

19:43

John and you download Currence.

19:46

And the first step is you register with Currence and

19:48

open up your Reservoir Account. It takes three minutes, do it digitally.

19:52

And then from there, the only thing you need to do is reroute your direct deposit

19:55

to go to this, your new Reservoir Account. And then you link it to your checking account or wherever you spend money.

20:03

And then you just choose the amount of money that needs to get sent from your

20:06

new reservoir to your checking account. So what happens is your direct deposits in your spending environment are now coming

20:12

from you as opposed to your employer.

20:15

And that's it. And then the money just moves from there to your checking account.

20:20

That's where you spend your money and then every other dollar that, that you don't.

20:24

Consciously spend gets, gets saved and now you can make decisions on

20:28

what you want to do with that dollar. Do you want to spend it like you used to, or do you want to, in your, the

20:33

words you used, create another cashflow engine that will increase your income,

20:38

which will increase your standard of And then and then the gap continues to widen between your money coming in your

20:43

money going out and you want that space and that gap to continuously widen.

20:48

So and there's just more resources available to make the next choice.

20:52

And you can it's, you can, you have a control panel in the Currence app,

20:57

your Currence app, where you could, if your water heater breaks and you want

21:01

extra money or whatever, you want to spend extra money, you want to go on

21:04

vacation you just go in and tap a button and move it to your checking account.

21:08

But at least you're consciously doing that as opposed to letting it

21:11

evaporate from the checking account. So the, this is a podcast, a lot of times mostly focused on The Infinite

21:17

Banking Concept and whole life insurance. And what you just said is something that I also appreciate about

21:23

whole life insurance, where. It creates a little, there's a little bit of a pattern interrupt.

21:28

You have a hundred percent control over everything, but you have

21:30

to take a small little step. There's a little speed bump that creates a scenario where you

21:36

have to consciously think about. What am I, okay, what am I doing with this money?

21:41

As opposed to your credit card where you just, you can sign up for

21:44

anything or spend it on whatever. When you have cash value on a whole life insurance policy, when you take out a

21:50

policy loan, there's a little bit of a step involved that that gives you that

21:54

pause to consciously, make sure what you're doing is the right next step.

22:00

What how does this tie into IBC?

22:02

By the way, I've known Dave, I've been, involved with Currence for

22:06

longer than this, but Dave was just at the Infinite Banking Think Tank

22:10

a few months ago in Vegas, where he gave a talk, and he said some great

22:14

things as Currence pertains to IBC.

22:18

For all my listeners, All the listeners that are really into the Infinite

22:21

Banking Concept and Whole Life Insurance. Can you talk a little bit about how this ties into that that world?

22:27

Absolutely. So if you're doing IBC effectively you probably have more than one, You

22:34

probably have loans that are purpose for certain buckets of spending or investing

22:39

in other things, and you probably end up with a lot of things that are a

22:43

lot of transactions to manage, right?

22:47

Currence just becomes, the reservoir, becomes the operating account for

22:52

your IBC for your family bank, right?

22:55

So you still have to. Make transactions, but what we want is to have it happen in this environment,

23:04

this frictionless environment before we send money to our checking account.

23:08

So I only use my checking account for spending money.

23:11

So to me the Currence just manages the movements of insurance

23:15

premiums Policy loans and dividends or however you're doing that.

23:20

And then you just choose how much money needs to go to your checking

23:23

account for lifestyle choices. So Currence becomes the glue of managing all the policies and all the transactions

23:31

in a frictionless environment. And then you already know how much money needs to go out for spending.

23:35

And then you just have Current send the money to your checking account.

23:38

And and from a tactical level, are does everything go to one checking

23:42

account or do you ever, split things up into different checking accounts

23:46

that have different purposes, in our world, there's that idea of

23:48

the wealth coordination account. Does this replace a wealth coordination account or does this go in front

23:54

of a wealth coordination account? How's that

23:56

it depends on how you use, Wealth Coordination Account means a lot of

23:59

things to a lot of people, right? The original is, this is a digital, technological, delivered

24:04

Wealth Coordination Account. And When we build Currence the right way, we build your cash flow structure

24:10

the right way, the way that I recommend people start is you implement it into

24:15

the life that you're living right now. So if you have one checking account, you should connect

24:19

Currence to one checking account. As you evolve, and you might want to bifurcate your spending into

24:26

different buckets, you may want to open up another checking account for

24:30

that area or bucket of consumption.

24:32

So I'll give you an example. My wife and I, we have five different checking accounts.

24:40

I have one for my household fixed expenses, right?

24:44

So I know exactly what that is every month. I drip money from my reservoir into my fixed expense account.

24:51

My wife has her spending account, which is, she takes care of all the stuff

24:55

for the kids, the food shopping, all the stuff that she pays bills for.

24:58

I know pretty much on average, it fluctuates every month, but

25:01

I know on average what it is. And then I just feed that account with how much money that is.

25:06

I too have my own personal spending account.

25:09

And I drip money into there. That just keeps me on track.

25:12

I'm choosing how much money I want to spend.

25:14

So I know if there's money in there, if I want to hit the ATM or buy a

25:18

new golf club or whatever, right? Like I know how much money's there.

25:22

We have another account for education.

25:25

My kids go to private school. So their uniforms, their books, all that stuff.

25:29

Like I know what that should be over the course of the year. And I feed that account.

25:32

And then we have a travel account, which is our vacation fund.

25:36

So I know I don't want to spend more than 18, 000 a year, let's say, on vacations.

25:41

I trip 1, 500 a month into that account.

25:43

When there's money in there, we book a trip. If there isn't, we, maybe do something different.

25:48

But everything has its own perspective. Now, I didn't start with all those accounts.

25:53

I started with one right? And then we added them over time.

25:58

And then what's interesting is that when you do that, the default

26:01

is to always accumulate and save every dollar first and invest it.

26:06

I'm just choosing how much money is feeding these buckets of consumption.

26:10

But I'm now able to apply different inflation rates to

26:14

different areas of consumption. Right?

26:17

Like my fixed expense account it's probably going to be the same or have

26:21

a very small inflation rate, because my property taxes are going to go up a

26:24

little bit, but it's the biggest area of consumption, but it's also going to

26:29

have this, the lowest And that's it.

26:34

I hope you found this helpful.

26:40

I'm John Furrier, the founder and CEO of TheFifthEdition.

26:49

com. I'll see you next time.

26:56

And you just mentioned the word recalibrate, which is, from my

27:00

perspective as a current advisor calibration sessions are, a part of

27:05

the, a part of my practice with working with people to help them with Currence.

27:10

What's a calibration session all about?

27:13

Or like what, what's a, when you calibrate, what are you doing?

27:16

Early in my career and mostly every financial advisor, everybody in the world

27:21

of finance, every financial professional is trained to have annual review

27:26

meetings with their clients, which is.

27:29

The most boring thing on the planet because it's all about

27:32

what happened in the past, right?

27:34

It's there's no real valuable agenda to the meeting because you're just

27:40

reflecting on what's already happened. What I learned in my training in economics is it's really about what's

27:47

the best choice I can make today with the resources I have available.

27:51

So you live in a constant state of calibration, making the

27:54

most efficient choice you can. With the resources that are available.

27:58

And then you do that again and again. So the way that we work with our clients is it's a constant state of choice making.

28:05

It's a constant state of calibration because you may have gotten a pay

28:09

raise, you may have gotten a bonus, you may have gotten a promotion, you

28:12

may have paid off your car, right? So all these things.

28:15

And when you have your connected cash flow structure, you're able to take

28:19

advantage of all those life events to actually increase the widening

28:22

between the inflows and the outflows. And that's how we work.

28:27

It's I'm gonna give you an analogy and hold that thought if you don't mind, it's

28:29

if you and I are playing chess, like we're all given the same pieces to play the game

28:34

but one of us is a better chess player. And there's always one optimal move.

28:39

And when you're looking at the game board and you can see what's on the table, we

28:42

know, should I be playing offense here?

28:45

Should I be playing defense? There's always one optimal move, and that current strategist client relationship

28:52

of calibration is always about examining what's going on in their lives, what's

28:56

the optimal move I can make today, and keep in mind where they want to be.

29:01

I love that you just said that because a lot of what we do in the infinite

29:05

banking world and as advisors that focus on, whole life insurance and creating

29:10

at least a part of your life as a certainty piece, having those guarantees

29:15

gives you that Ability to make that optimal move when you need to make it.

29:21

Whereas most people are really just focused on these, this

29:24

accumulation path that really ties you into a trajectory that.

29:29

You can only make a, a couple moves at any given time without, having penalties

29:35

or paying taxes or liquidating, or, losing the growth on something over

29:39

here to get some growth over there. And and I'm pretty convinced that this upfront cash flow piece is the

29:47

key to making everything else work.

29:50

If you look at all at our, the stages in our life, you get your first job, you

29:55

have the accumulation stage, you have, you get married and start having kids.

29:59

Then you start getting close to retirement, then you go into

30:02

retirement, and then, you have all the challenges you have to deal

30:06

with during, as you get older.

30:09

And then there's the time when you pass away and it's time to leave a legacy.

30:14

Like most people are really only focused on trying to accumulate and create a big

30:19

account to handle all of these things.

30:22

Imagine all the challenges and all the, changes that are going

30:26

to happen during your life. And all you have to, all you have to handle that is one type of financial

30:32

asset, like the stock market or whatever. Some people are into real estate, which is great, but if you can

30:38

address the spending upfront.

30:41

And tackle that one piece before it trickles into the, through time,

30:46

through the rest of your financial life, it creates an astounding

30:49

improvement in every single phase.

30:53

Yeah. A hundred so this is really what I'm trying to push out to, my clients and

30:57

my new clients right now is like, Hey, we're doing all the IBC stuff.

31:01

Here's another thing I want to say, Dave before I go on that.

31:04

So we're doing all the IBC stuff, but IBC doesn't actually Solve a spending problem.

31:12

If you have one it helps a little bit because it does

31:15

create some forced savings. Sometimes people call it, so there is that piece of it, but if you have a

31:20

spending problem, you're in control of this thing and you can borrow

31:23

against that policy to the nth degree.

31:26

And I've seen it happen over and over where people just, they don't

31:30

get control of their spending. They borrow everything against the policy.

31:34

They lose their job. They can't make a premium payment and the whole thing blows up.

31:38

That's a spending problem that IBC does not necessarily address.

31:42

And this creates a pathway to consciously address your spending and get that

31:50

under control before it even goes into your into IBC, where then we can just

31:55

make all of those great improvements. throughout,

31:58

you will be able to do more of IBC by having the cash flow structure, right?

32:03

And you're right. You're right. I call them, erosion factors or external forces that are working against us, right?

32:10

If you look at it through the accumulation phase, we have pressure to make money,

32:14

pressure to keep it, pressure to grow it. You could get sued.

32:17

You could die early. You can get sick. Like all those things are really working hard against us.

32:23

And then you have Parkinson's law, which is about like the

32:26

propensity to consume, right? When you reach that point where you're theoretically retired, all those pressures

32:34

that I just described are like 10x more powerful working against you because you

32:40

can't just go to work and just replace the money that you made a mistake with, right?

32:44

So the game gets harder as you go.

32:48

And you're right. What we've done with our clients with Currence is that you create

32:52

what's called the spending baseline. Which is how much money am I routinely spending to live the

32:57

life that I'm living today? And then when you have that data, that historical data and the trends, you're

33:02

able to make really powerful decisions throughout the rest of your life.

33:07

Because you know what your consumption is, what your lifestyle demands are.

33:10

It's such an important thing too. And it, and guarantees matter, there's so much stuff out there about just like

33:18

returns and all this other stuff, but by the way, this leaks into the IBC world a

33:23

little bit too, where there's a lot of, fluff and on YouTube and social media.

33:28

And yeah. There's this huge focus on, Hey, you've got to get this correctly

33:32

designed, quote unquote, correctly designed policy that maximizes

33:36

the cash value in the first year. And by the way, the reason I want you to have that is because I have

33:41

this other thing that I want you to use that cash value to invest in.

33:45

And so it becomes, you know, and I'm, I'm not, saying that this is across the

33:49

board, but there are definitely, some groups out there that will lead you into

33:55

focusing the cash value, which creates.

33:59

Potential problems in your policy itself, and then they want you to max leverage

34:03

that cash value to then go invest in whatever they want you to invest in.

34:08

And in this scenario, because we're focusing on savings and spending.

34:16

We've already demonstrated with the Maximum Financial Potential Calculator

34:20

that you don't have to take that risk and put yourself in a position where

34:25

you're max leveraging every last dollar in your system to try to get a return.

34:30

By the way, everything is at all time market highs right now.

34:33

What, everyone's just they just invest in stuff because it's there.

34:37

Invest, we should be investing for the right reasons and Being liquid and having

34:42

a bunch of cash on hand when, when things become cheaper again, that's going to

34:47

be, that's where real wealth is created

34:49

A hundred percent. There's an intrinsic value on having your money available to you.

34:54

And having your money's in an asset that the values truly are guaranteed.

35:00

The game here is how do we automate this stuff so that you're giving

35:04

yourself the best chance of success?

35:07

It's like technology is finally catching up to what IBC can do.

35:12

All Right. And so that's what we're that's the opportunity here, as an

35:16

advisor, I believe two things. You cannot reach your full financial potential without the acquisition

35:21

of whole life insurance for all the reasons you just described.

35:26

And two, you can't reach your full financial potential without having an

35:29

efficient connected cash flow structure. Everything else is just choice.

35:34

And, Nelson Nash wrote in his book, Becoming Your Own Banker he said,

35:38

don't be afraid to capitalize. And what that means in our, In the perspective of IBC, don't

35:44

be afraid to pay a premium. And, so a lot of people go into this being scared of paying a

35:49

premium because they're, guess what?

35:52

There's no free lunch surprise, surprise.

35:54

And there's some costs involved when you first start a whole life insurance policy.

35:59

And there are so many people out there that try to play this smoke

36:03

and mirrors game and show you that, Hey, you can minimize these

36:06

costs and get these premiums. Special policies that, by the way, all have trade offs.

36:11

Everything's a trade off in the insurance business.

36:14

But the, I, what I'm trying to get to here is if you have your cash flow

36:18

structure figured out, you're not worried about, How you're going to pay a premium.

36:22

You want to pay as much premium as possible because where else could it

36:26

be doing all the things that it could possibly be doing than in a whole

36:30

life insurance policy where it goes, it basically goes second now because

36:35

now we have the reservoir where our money goes first and captures every

36:39

single dollar that comes into our life. And now the whole life insurance can be the second place that it goes before you

36:45

then use it to go do other things with it.

36:48

almost see them as connected, right? Because you can't actually deposit your paycheck into a life insurance policy,

36:54

That's right. right? And you can't actually, go to Costco and, pay for something with

37:00

your life insurance cash value. Like it actually has to connect to a financial account and a

37:05

debit card or whatever, right? So this just becomes this environment that's connected to

37:10

your policies, your IBC policies.

37:13

That's just a conduit to fund it and actually manage the

37:15

loans and all the transactions. that's right.

37:18

And that's about phase two of Currence, which is the acceleration, which is about

37:21

where do you put the money that you keep? And you should always be in a spot where you always have access to your money

37:29

because the more money that you have, the more money that you have access to, the

37:35

more opportunities that you will see start popping up that you didn't necessarily

37:40

have the right context to see in the past. So we're talking about creating velocity of cashflow and more liquidity so that you

37:48

have opportunities to invest in yourself. that's awesome.

37:53

You've been doing this for a while. You were, you've been doing this even before Currence was a, was a thing.

37:58

If you were to just, I don't know, Say a results with any kind of numbers

38:04

that you might be able to share. Of course, you're not going to give any information away, but what kinds

38:09

of improvements have you seen people able to make, for the, the length

38:13

of time you've been doing this. So how you've been doing this for what?

38:16

20 years manually Yeah, about close to, probably about, I think the first person that we did

38:23

set this up, reversing the direction of the money, was probably in 2007.

38:30

And we did it with what was available to us.

38:32

It was like, drawings on legal pads and we would use a brokerage account because

38:36

at the time I was a registered rep. And I was able to open up a brokerage account.

38:40

It's the only way that I could set up, scheduled movements of money and see.

38:45

And anybody there's two ends of the spectrum, right?

38:49

Like you take the young person that got their first job, they need to

38:53

do this because they're going to create their spending and separate

38:56

their consumption from their income. So as they go through life, they're going to take control of

39:01

as much money as possible this way. What's interesting is that on the other end of the spectrum, you have

39:06

the retiree when, when you retire, you probably are used to getting, two

39:12

paychecks a month on the 1st and the 15th.

39:15

And you're used to that, right? Probably for the last 40 years.

39:18

And then you retire and you're going to get two social security

39:20

checks, possibly two pensions.

39:23

Maybe you have some other, passive income sources and it's

39:25

hard to make sense of all of it. What this does is allows you to say, okay, if my spending baseline was

39:31

making it up 10, 000 a month, and I have this history, I know how much money I

39:35

need to solve for with the assets to feed, when my earned income drops off.

39:39

So having everything dump into this reservoir helps you make sense of all

39:44

of it and make really powerful choices.

39:47

But to answer your question so we've had success with people.

39:50

In the latter parts of their life and people that are just getting their

39:53

career started, everybody in between. When this hit me cause we were doing this and then I started training

39:58

other advisors to do this and we were all having the same stories.

40:01

Holy cow, these clients saving so much more money.

40:04

Then they ever thought possible, right? Like I literally have clients that I started working with in 2007 when they

40:12

got out of their, if they got out, just got out of law school or either

40:15

medical residency or just even, if you're just a professional, I have

40:19

clients that were used to making 70, 000 a year at that time coming

40:24

out of their, their first legal job. Now make a million dollars and still live on 12, 000 a month and don't

40:30

miss anything because they have so much velocity in their cash flows.

40:33

Like they're living their best life. They're basically financially independent before they're 40, 42 years old.

40:39

Like we have tons of clients that way. The average current user is saving 30 percent of their after tax income.

40:45

And that accounts for all the people that are saving zero and the people that are

40:48

saving, 80 percent of their income, right?

40:51

So it's the number, but the average is thirty.

40:53

Which is incredible in a very short period of time.

40:57

So the longer your tenure is in Currence, like the, the more

41:01

cashflow that you're able to capture. I worked with a client that we opened an account, literally a husband, wife,

41:08

early forties, two kids, couldn't save a dime, had a lot of credit card debt.

41:13

And literally a year and a half ago we set this up, we opened their reservoir,

41:16

they put 10 in the account, connected their cashflow structure, and they

41:21

saved, I think, 130, 000 in 18 months.

41:26

That's awesome. They're able to pay off their credit cards.

41:30

We were able to get insurance in place and, get everything

41:32

in place that they need. Now they're talking, then they both, coincidentally, they both

41:35

just got really good raises and promotions and their incomes.

41:40

Now their household income's up almost six figures from where it was two months ago.

41:45

And so now, like they're talking about buying vacation homes and, Like it it's

41:49

incredible, so during that journey, there's so many stories which is why I

41:54

decided to put my, my career on hold as a, as an advisor and lean into this because

42:01

I knew we needed to build something to make this available to everybody.

42:04

So we offer Currence and we give it, we help financial professionals

42:08

work with their clients and we give them, deliverables on both sides.

42:11

So as a, the thing is, if you work with a Currence Strategist.

42:15

They're given a dashboard where they can actually manage an entire population

42:19

of clients and all their cash flows. So we're giving the advisor the opportunity to be the best advisor

42:25

they can through this, because you're able to see metrics that

42:28

you can't get anywhere else. So Yeah, it's fantastic.

42:32

Like I said, I started doing this myself and found benefits right away.

42:38

I found money, thousands of dollars, tens of thousands Really what it mostly is, is

42:42

not like personal spending, but like, it's easy for me to spend money on my business,

42:48

you know, just buying a marketing thing here or doing this over there.

42:51

And that's actually where a lot of the money was kind of like, oh,

42:54

wow, I didn't realize I was spending that much on, on that type of stuff.

42:58

So, that story is incredible.

43:01

And as we start wrapping up here, anything that you, anything else you'd like to

43:05

get out there and let people know about?

43:08

Even from an advisor perspective, cause we have other advisors that

43:11

listen to this podcast as well. I've, we've, at Currence, we value human advice.

43:17

And, part of our mission is to empower the financial advisor community

43:23

with technology that allows them to compete with all these advancements

43:26

that are happening around us. And I believe that if you marry best in class technology with

43:34

best in class advice, the clients get the best in class experience.

43:40

so if you're an advisor, like.

43:43

One, you don't want to be on the outside looking in and saying, wow, all this

43:47

technology is leaving me in the dust. Clients, you want to work with a professional that uses Currence

43:53

because they're going to be more proactive in your life.

43:56

You're going to be able to automate stuff in, and I promise you, you

44:00

will have more control of your cashflow, more than you ever realized.

44:03

And You will say, like I say to myself, I wish I had this 10 years

44:07

ago because it is that powerful.

44:10

And the elegance is in the simplicity, right?

44:14

And so we're grateful for the opportunity to bring this to the public.

44:18

We're grateful to support advisors and we're, we're giving people

44:21

financial freedom and that's, that's what it's all about.

44:24

I'll leave a link for consumers to go for you to, To check this out, you can

44:30

go to StrategicWholeLife.com/Currence and you can learn about, how this

44:35

gets implemented in my practice. If you'd like to, talk with me about this where can people go if another

44:41

advisor is listening to this, Dave, and they want to learn about how they

44:45

might be able to implement this in their practice and work with you.

44:48

Yeah. They can go right to liveCurrence. com. Um, and click join and there's a pathway that you can go

44:55

to get to us as an advisor. There's a pathway that you can get to your advisor through like

45:00

John, you sent the link for you. Yeah, hit us up at LiveCurrence.

45:04

com, L I V E C U R R E N C E.

45:07

com. Oh, that's a great point.

45:10

I forgot to mention it's spelled CURRENCE.

45:12

C U R R E N C E.

45:15

And so it's StrategicWholeLife.com/Currence.

45:18

C U R R E N C E. And of course, I'll put the links in the show notes.

45:21

This is great, Dave. Thanks so much for taking some time and, walking us through this.

45:26

I really do believe, the work you've done is absolutely incredible.

45:30

I really do believe that this frontline cashflow structure is maybe the most

45:36

important piece of, of what's going on. Putting the whole thing together and creating fantastic

45:40

results in your financial life. Thanks a lot. Thank you for saying that.

45:43

Thank you for having me. It really became obvious to us when we were seeing the

45:46

results that we were getting. That our clients were having, we realized that this didn't

45:50

exist anywhere and we needed to build it, and that's what we did.

45:53

Thanks for having me, thanks for giving me the opportunity to share with your audience.

45:57

Awesome. And hey, if you're listening out there and this is resonating with you and you'd like

46:02

to find out how this could potentially apply in your life specifically,

46:05

head over to strategicwholelife. com and you can get you can schedule a free 30 minute consultation with

46:11

us right there, or if you're the type of person like I was that just likes

46:15

to read and learn as much as you can before talking to anyone, you can get

46:18

access to our online course, IBC Mastery at StrategicWholeLife.com there's a

46:24

link right at the top of the website. And one more time, if you'd like to just talk about Currence, you can go

46:29

to StrategicWholeLife.com/Currence.

46:33

Thanks again, Dave. Thanks everybody. We'll talk to you soon.

46:35

Bye. Take care.

From The Podcast

Strategic Whole Life by Infinite Banking Authorized Practitioners

The Infinite Banking Concept® (IBC) is privatized banking, using the cash value of a whole life insurance policy as the platform.Your hosts, John Montoya and John Perrings, are authorized IBC practitioners with the Nelson Nash Institute, dedicated to educating consumers about Infinite Banking.Listening to this podcast, you'll learn about life insurance, cash value, dividends, policy loans, policy design, and more. Most importantly, you'll learn how IBC puts you back in control of your money so you can keep it, grow it, and pass it on without taking any of the unnecessary risks that you otherwise get when you listen and follow the mainstream advice about personal finance.The Strategic Whole Life podcast is our way to carry on Nelson's mission by explaining The Infinite Banking Concept® in simple terms so that you can make it real in your life!Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

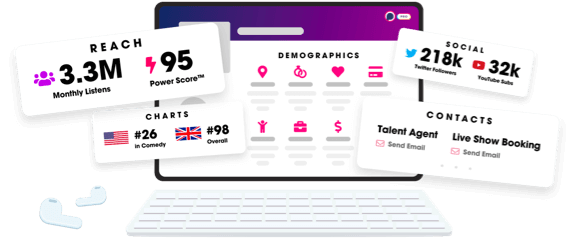

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us