How does the IRS calculate your ability to pay?

Your ability to pay is something you need to understand when you’re trying to resolve your IRS tax liability.

Your ability to pay is one of two factors the IRS uses to determine how to resolve your case and it’s calculated based on your income and expenses. That might sound simple enough, but creating an accurate representation of your income and expenses can be a lot more complicated than it seems.

In this episode, we’re getting into the nitty gritty of calculating your ability to pay, including what to look out for and how to avoid paying more than you can afford.

If you have a tax problem, this episode is going to help you.

Show notes are available at www.brysonlawfirm.com.

Resources Mentioned:

Calculating a Taxpayer's IRS "Ability to Pay" Presentation PDF Guide: https://drive.google.com/file/d/1bQ69b3REibd82KDprEC7REaF484dOgqJ/view?usp=share_link

Connect on Facebook: www.facebook.com/BrysonLawFirm and LinkedIn: www.linkedin.com/company/bryson-law-firm-l-l-c.

From The Podcast

Talkin' Tax

Co-founders of the Bryson Law Firm, Cary and Angela Bryson, have over 40 years of combined legal experience in Louisiana and Texas and have built a thriving and successful law firm that aids their fellow “Loosianans” and Texans when it comes to the complicated realm of taxes.Together with the help of their roots, experience, and deep insight, they break down topics such as bank levies, lien assistance, tax resolution, payroll, and more on their podcast Talkin' Tax for anyone who needs a little bit more guidance. Rest assured that Cary and Angela, who are rooted in faith, family, and taxes, will help you understand your tax problems and find the best solution for them one episode at a time.For more information, visit www.brysonlawfirm.com.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

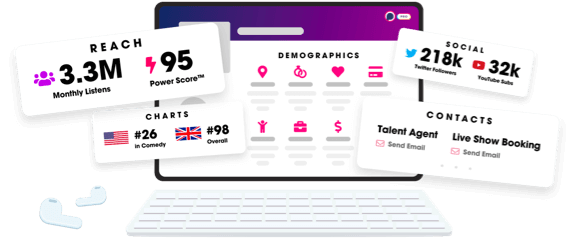

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us