Jesse starts this episode with a confession: money still stresses him out. The four ways that Jesse reduces this stress are remembering what’s going right financially, prioritizing spending, working hard, and remembering that others have walked this path.

Then, with another call back to his blog, Jesse invokes Marshall McLuhan’s quote “the medium is the message” when sharing from his post, “The Friction is the Message”.

Today’s guest is Carl Richards, the creator of the Behavior Gap, author of The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money, and host of Behavior Gap Radio. Not only has Carl been featured on Oprah.com and Forbes.com, he’s the creator of the Sketch Guy column which ran weekly for a decade in The New York Times. In this episode, Carl gives us some great insight into how we can refocus ourselves and our finances on what really matters to us.

If you’re interested in not only financial planning, but time, energy, and attention planning, too, then this is the episode for you!

Key Takeaways:

• 4 ways Jesse reduces his financial stress.

• Friction as a bad thing, and friction as a good thing.

• Why you should invite imposter syndrome in.

• What is the Behavior Gap?

• How to choose your financial advisor.

• How to manage your money, time, energy, and attention.

Key Timestamps:

(02:10) Jesse’s Monologue: Money Still Stresses Me Out

(07:24) Managing Financial Stress: Four Key Reminders

(13:42) The Friction is the Message

(22:14) Carl Richards Joins the Conversation

(28:48) Why Carl Shares

(30:41) Overcoming Fear, Anxiety, and Imposter Syndrome

(39:02) The Behavior Gap in Investing

(44:48) The Value of Real Financial Planning with a Real Advisor

(52:28) Conclusion and Resources

Key Topics Discussed:

The Best Interest, Jesse Cramer, Rochester New York financial planning, financial stress, human capital, personal energy, mental attention, financial advisor, imposter syndrome, financial anxiety, the Behavior Gap, the Friction is the Message

Mentions:

Website: https://behaviorgap.com/

LinkedIn: https://www.linkedin.com/in/thinkingcarl/

Mentions:

https://bestinterest.blog/money-still-stresses-me-out/

https://bestinterest.blog/the-friction-is-the-message/

https://bestinterest.blog/selling-and-surviving/

https://behaviorgap.com/radio/

More of The Best Interest:

Check out the Best Interest Blog at bestinterest.blog

Contact me at jesse@bestinterest.blog

The Best Interest Podcast is a personal podcast meant for educational and entertainment. It should not be taken as financial advice, and is not prescriptive of your financial situation.

From The Podcast

The Best Interest - Complex Personal Finance Made Easy

Why is personal finance so complicated? Even worse, the Internet is full of personal finance “experts” providing short-sighted, error-prone, and outright bad financial advice. Jesse Cramer has a knack for using everyday experiences to make personal finance accessible for the average investor. His extensive research coupled with skilled narrative makes personal finance actually enjoyable.By day, Jesse works for a fiduciary wealth management firm in Rochester, NY. By night, he runs The Best Interest - nominated in 2022 for "Personal Finance Blog of the Year.” The Best Interest simplifies personal finance and investing to make your life easier, smarter…and a little richer, too. Come invest in knowledge with The Best Interest.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

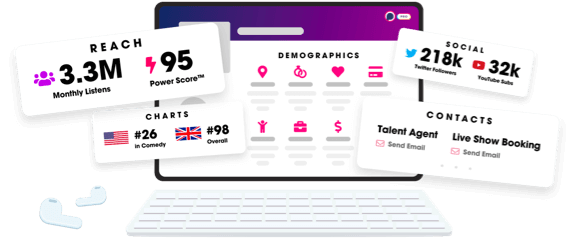

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us