Episodes of The Financial Answer

Mark All

Search Episodes...

As we navigate through the year, the economic and political landscape remains a topic of concern and speculation. Are there still predictions of a recession looming over us? If so, how can you shore up your financial position, no matter what th

Should you get into cryptocurrency? Cryptocurrency has been a hot topic for years, often seen as the Wild West of the financial world. However, recent developments suggest that this once-fringe investment is moving into the mainstream. One of t

In this special Father's Day episode, Nathan dives into classic “dadisms” to draw out valuable financial lessons from them. We discuss the importance of avoiding knee-jerk financial decisions, understanding the true weight of financial burdens,

Are you guilty of putting all your eggs in one financial basket? The latest episode of our podcast delves into the critical topic of investment diversification. We discuss everything from common mistakes Nathan sees to historic examples of when

While the stretch IRA has been gone for a few years now, a new tweak in the rules has added some confusion. On today’s episode, we discuss what this may mean for inherited IRAs and look at a recent article from CNBC to break it down. Currently,

Are you ready for a reality check when it comes to retirement? Today we wade through the myths and truths of post-career life, where the expectations of endless cruises clash with the reality of budgeting for healthcare. Learn why setting reali

It’s almost derby time! But what does it take to take home the crown? On today’s show, we talk about the things you’ll want to keep in mind to win big when it comes to your financial plan. From training for the moment in the best way to underst

No matter what generation you’re in, you likely have questions when it comes to retirement. In this multi-part series we will discuss the different questions common among different generations. Today we talk through how to best prepare for that

Sometimes technology and innovation can help simplify and streamline things, but other times it can cause more of a headache than before. Today, we talk about what can become more complex and what is improved when you introduce technology into

How have things changed since when your grandparents were planning for retirement? So many things have gone up in cost! Instead of pretending things are still like they used to be or avoiding the topic, it’s important to face some of these fact

We’ve all heard our parents or older generations say, “Well, back in my day…” Some things that were harder in the past have been eased with technology and other advances. But other things have become overcomplicated or more difficult. Today, we

We’re living in a fast-food world, but sometimes it’s worth waiting for the good stuff. Making financial sacrifices can be hard, but today we talk about when the delayed gratification is worth it. From saving for your future to having what you

More and more people are getting an inheritance these days. In today's show, we answer some of the common questions people face when receiving, or planning on one day receiving, an inheritance. Hearing these questions may help you prepare ahead

As we near the holidays, you might be scrambling for last-minute gifts and preparing for a festive celebration. For many of us, the gifts in the stocking cover a range of everything from practical to absurd. Today, we talk through some of the f

‘Tis the season for a bit of holiday cheer! What can we learn about financial planning from some classic Christmas songs? These tunes we sing along to every year carry some great metaphors and lessons if you know where to look. For instance, we

Ready for an adventure? Sometimes climbing a mountain is full of adventure, and sometimes it’s more about being prepared. You have to get the proper gear, get used to using it, and practice before you summit a major mountain. Doing something st

What can we learn about retirement planning from browsing the cereal aisle at the grocery store? We love finding relatable ways to teach about financial topics, so let’s scoop up a few bites of financial understanding on today’s show.Here’s

It’s always better to learn from the mistakes of others so you don’t have to make them yourself. In this episode, we talk through some common financial mistakes people make and share what you can do to avoid them. Remember, thinking through the

Let’s look at some of the hidden questions that come up when retirement planning. Whether you have put them off to the side or would rather focus on something else, all of these things are important components of your retirement plan. Talking t

Radio talk show host turned TikTok user, Dave Ramsey, is known for doling out financial advice to a wide audience. Today, we talk through some quotes from Ramsey to see what Nathan thinks as a financial advisor. Be it investing from a place of

When we look toward the future, what’s ahead? Whether you take more of an optimistic or pessimistic view of things, it’s important to know what to expect. In this episode, we talk about what Americans may face when it comes to retiring in the y

In a shocking turn of events, we’re going to spend some time bashing the Roth today. Inspired by an article we found on Yahoo Finance, Nathan shares his thoughts on a Roth. Is it really the right thing for you? Instead of basing your decisions

We’re back for another segment where we see what lessons we can learn from popular quotes. Join us as we delve into the world of fiction and explore the valuable financial lessons we can learn from the beloved character Ron Swanson, portrayed b

Welcome back to part two of our discussion on resolving financial tension between couples. In this episode, we'll explore five more common areas of financial strain: emergency fund size, charitable contributions, handling inheritances, insuranc

Money can't buy love, but it can certainly start some spicy debates between you and your better half. In this episode, we're digging into the financial face-offs that make Monopoly fights look like child's play and exploring some money minefiel

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

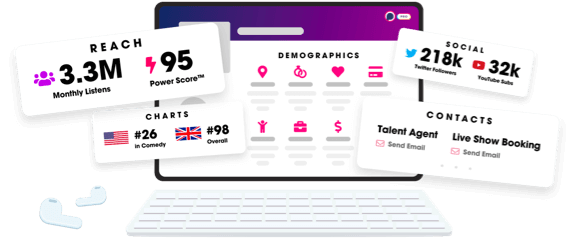

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us