Dr. Jim Dahle of the White Coat Investor

White Coat Investor Podcast

Good podcast? Give it some love!

Dr. Jim Dahle of the White Coat Investor

White Coat Investor Podcast

Good podcast? Give it some love!

Rate Podcast

Episodes of White Coat Investor Podcast

Mark All

Search Episodes...

Today we are answering more of your questions. We start off talking about a terrible fraud situation and how to attempt to mitigate the damage. We answer a few questions about asset protection and then a few questions about 529 accounts and how

Today we are chatting with an ER Doc who has reached millionaire status! He comes from an immigrant family and learned young the importance of hard work, education and building the life you want. He started paying off his student loans during r

Today on the podcast we are talking with Kyle Claussen from Resolve. He chats with Dr. Dahle about the importance of really advocating for yourself and your pay when starting a new job and signing a new contract. It is critical to negotiate unt

Today we are talking with an ENT who has paid off $300,000 of student loans. This is a doc who was comfortable paying the loans off over time while he continued to save and invest and build wealth along the way. He and his wife put a lot of mon

Today we are answering your questions about retirement accounts. We start out by addressing the recent change with Vanguard getting out of the solo 401(k) game. Then we talk about if you can contribute to both a solo 401(k) and the TSP if you a

This pharmacist has paid off $286,000 of student loans with just over $200,000 of that in the last 15 months. How did he do it? He basically doubled his income by getting a higher paying job and working a side gig in retail pharmacy on the week

Today we answer your questions about rolling over an HSA, when to withdraw from your HSA, whether a UTMA or Custodial Roth IRA is better for your kids, if it is a good idea to open a solo 401(k) for your kids, how to maximize your 403(b) contri

This VA emergency doc has paid off $370,000 in student loans in only 5 years! Not only that but he and his wife are already millionaires. He said it is impossible to overstate how good it feels to have paid off those student loans. They have a

Today we spend some time talking about what to do when you and your spouse or partner do not see eye to eye about certain parts of your financial life. It can be extremely difficult when your vision does not align. But it is critical to work th

This hospitalist has paid off $155,000 in only 2 years! He said he was able to stick to his aggressive payment plan because he also allowed himself to enjoy his life along the way. He left room in his budget for some travel and some of the litt

Today we answer several of your mortgage questions including if you should put all the money you can toward your down payment or use some of it to pay off student loans and what kind of mortgage you should get. We discuss a unique situation aro

Today we are talking with a family doc who has hit a big net worth milestone. He has been paying down debt all while building wealth totally half a million dollars. He tells us that he has been saving aggressively and accomplishing his financia

Today Dr. Dahle chats with Gastroenterologist, Dr. Ian Storch about all things DO medicine. They go in depth about DOs, including the history of Osteopathy and how that affected osteopathic education and practice today. They discuss the differe

Today we interview an MS1 who is celebrating making a budget for the first time. He said he wants to inspire others to do whatever they can to mitigate the financial burden of medical school. He shared that simply by having a budget he is actua

Today we are answering your asset allocation questions. We talk about how to adjust your asset allocation and when to do it, what changes with asset allocation when thinking about your long vs short term investment plan, how to make the most of

Today we are celebrating this orthopedic surgeon completing his military commitment and becoming a millionaire. This doc served our country for 16 years and is now moving to a civilian job. They are moving from California to Minnesota and are l

Today Dr. Dahle is answering all of your questions about taxes. He talks about FICA taxes, quarterly estimated payments, IRA contributions and tax deductions, paying taxes when you work in two states in one year, how to make your tax situation

Our guest today has a unique and inspiring story. He shares his journey from college to homelessness to financial success. He talked about what he learned and how he views the world on the other side of homelessness including gratitude for what

Today our friend Dr. Tyler Scott is joining Dr. Dahle to talk about disability insurance as well as to help answer your questions. Dr. Scott is a licensed dentist turned financial planner as well as a columnist here at WCI. Dr. Scott is here to

This anesthesiologist has become a millionaire only 3 1/2 years out of training. She has a high income and is saving a massive portion of it. Not only is she building wealth for herself but she also sends money home to help take care of her mot

Today we are answering your questions about high yield savings accounts, why you actually need to write down your financial plan instead of just having it in your head, wether or not you should start a 529 if you are going to be an older parent

Today we are talking with a general surgeon who paid off his student loans only 7 months out of training. He then dove into growing his wealth and became a millionaire in 3 years. He said he and his wife have always been fairly frugal and good

Today we are talking with Britt Williams Baker, co-founder of Dow Janes. We explore the question of if there is a difference in finances for women vs. men. We discuss value aligned investing, what some financial stereotypes might be, how to get

This dual physician couple has paid off over $700,000 of student debt only four years out of training. They are both family docs living in California. They had the great insight that when you choose to live in California you need to view your c

Today we are answering your questions about how to get rid of a timeshare that was gifted to you, if it is legal or a good idea to use student loan money for a downpayment, if you should pay off your mortgage early and what recasting a mortgage

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

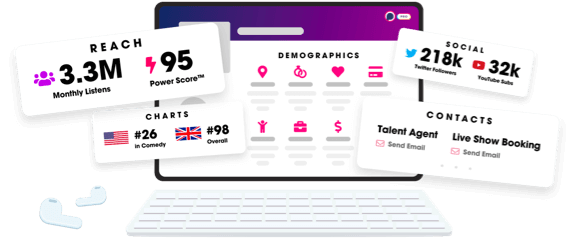

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us