Your Money, Your Wealth

Your Money, Your Wealth

Claimed 1 person rated this podcast

Your Money, Your Wealth

Your Money, Your Wealth

Claimed 1 person rated this podcast

Rate Podcast

Episodes of Your Money, Your Wealth

Mark All

Search Episodes...

Will their $5 million nest egg get them to ages 85 and 100? Pa and GiDi are 65 and 60 and retiring now. As they consider moving to the no-income-tax state of Nevada in retirement, they have some decisions to make: should Pa take Social Security

How much do retirees really spend in retirement? Does the Social Security Primary Insurance Amount (PIA) continue to rise with inflation? Is all the talk about higher future tax brackets just fear-mongering? Can "Johnny Mercer" afford to leave

Cinderella and her Prince Charming have a nest egg of $2.3 million and are hoping for retirement income of up to $150K/year. When can they afford to retire? How should they coordinate paying for some big purchases, paying off debt, and collecti

Market declines just before you retire, or early in your retirement, can really screw up your retirement income strategy. If you’re in the middle of the expensive kid years, how do you avoid this sequence of returns risk when making your retire

Should Mike in Virginia keep using his IRA money to pay the tax on his Roth conversions? How do you do a Roth conversion when you don’t have the money to pay the tax? That’s PeterLemonJello’s question, but is it the question he should be asking

Sunshine in Orange County has been waiting patiently since January for a full Retirement Spitball Analysis: how are her assumptions for rates of return and inflation, her plans for Roth conversions, her asset allocation and asset location, her

Are women better investors and financial planners? Today on Your Money, Your Wealth® podcast 483 with Joe Anderson, CFP® and Big Al Clopine, CPA, three different husbands want to retire, while their wives feel they need to work longer. Can Jack

Will building a new home delay Janelle's early retirement? Can Mike and his wife retire early at ages 50 and 55, and how much should they convert to Roth? Maria and her partner keep their finances separate - can Maria cover her own expenses in

Should 70-year-old Bob live off of capital gains and dividends from his mutual funds plus Social Security, or should he sell poor-performing mutual funds for living expenses and reinvest the cap gains and dividends? Which account should Neal’s

Kyle and his fiancée are in their 30s, have done a great job saving, and are in a high tax bracket. Would it make more sense for them to contribute to their 401(k)s or Roth 401(k)s for retirement? Mick’s wife Pam has both W-2 and sole proprieto

Linda is retired and financially independent. Her advisor suggests she have a separately managed account specifically for tax loss harvesting. Today on Your Money, Your Wealth® podcast 479, Joe Anderson, CFP® and Big Al Clopine, CPA spitball on

So you won the lottery - congratulations! After you celebrate, should you rip off the band-aid and convert the entire lump sum payment to a Roth IRA? That’s today on Your Money, Your Wealth® podcast 478 with Joe Anderson, CFP® and Big Al Clopin

Are there ever times when going all Roth isn’t the best strategy? How do you determine the break-even point on doing Roth conversions? That’s today on Your Money, Your Wealth® podcast number 477, as Joe Anderson, CFP® and Big Al Clopine, CPA sp

What is private credit and where does it fit in your investment portfolio? At age 60, Hope is tired of working and she’s hoping to retire in 2-3 years. Should she factor home equity into her retirement spending plan with a reverse mortgage? Whi

Will Duke and Daisy’s retirement spending plan work? If you’re a fan of hearing Joe Anderson, CFP® and Big Al Clopine, CPA debate, you’re in luck today on Your Money, Your Wealth® podcast 475, as they disagree on assumptions when it comes to re

Jimmy in Wisconsin will have a pension, Social Security, and a seven year retirement shortfall. How should he cover it? Skipper in Texas has some unusual pension options, which makes the most sense for his retirement needs? That’s today on Your

Why would a financial advisor suggest that Frank in Lake Wobegon sell a piece of inherited property, pay 25% tax, and invest the lump sum? Mark in Florida is 72 and invested in CDs. Should he go back to his financial advisor, or just buy more C

Rob and his wife in North Carolina are 51 and 44 and would like to retire in the next 3-5 years. Are they on track, and what should they consider as far as Roth conversions are concerned once the tax brackets go back up, which they’re slated to

Big Tex, Paul in Maryland, and Nick in Alabama all need to know how much money they should convert to Roth to pay as little tax as possible, today on Your Money, Your Wealth® podcast 471 with Joe Anderson, CFP® and Big Al Clopine, CPA. Johnny a

Barney and Betty in Maryland hit the jackpot. How’s Barney’s strategy for net unrealized appreciation, retirement withdrawals, and asset location for his $5 million employee stock ownership plan? Nick in the PNW will have $8 million when he ret

Erik in MN is divorced, and the OC Birdman of South OC is getting divorced. Should Erik contribute to pre-tax retirement accounts or Roth? How should the Birdman and his soon-be-ex time the sale of their house and the filing of their taxes? Tha

Are there general guidelines on what percentages of your investment portfolio should be in tax-free accounts like your Roth, tax-deferred accounts like your 401(k), and taxable accounts like your brokerage? Joe Anderson, CFP® and Big Al Clopine

What does retirement at age 60 look like for Allison in Northern Virginia? The EASIretirement.com calculator says Jimmy and Rosalynn in Georgia are on track to reach their retirement goals, even though they’re late starters - but are they being

Should Peter LemonJello, who has high income, and his wife, who is retired with zero income, file their taxes as married filing separately so they can start Roth conversions? What are the tax implications of Roth conversions for Randy in Chi-to

How and what should we teach teenagers about money, to make the next generation financially literate? That’s what CJ in Philadelphia and Teresa want to know, today on Your Money, Your Wealth® podcast 465 with Joe Anderson, CFP® and Big Al Clopi

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

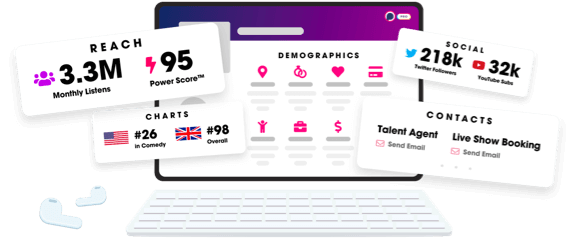

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us